Old Second Reports Fourth Quarter 2019 Net Income of $9.5 million

ACCESS Newswire

23 Jan 2020, 03:35 GMT+10

AURORA, IL / ACCESSWIRE / January 22, 2020 / Old Second Bancorp, Inc. (the 'Company,' 'we,' 'us,' and 'our') (NASDAQ:OSBC), the parent company of Old Second National Bank (the 'Bank'), today announced financial results for the fourth quarter of 2019. Our net income was $9.5 million, or $0.31 per diluted share, for the fourth quarter of 2019, compared to net income of $12.2 million, or $0.40 per diluted share, in the third quarter of 2019, and net income of $8.6 million, or $0.28 per diluted share, for the fourth quarter of 2018.

Operating Results

- Fourth quarter 2019 net income was $9.5 million, reflecting a decrease in earnings of $2.6 million from the third quarter of 2019, and an increase in earnings of $916,000 from the fourth quarter of 2018. Fourth quarter 2019 financial results were negatively impacted by net interest margin compression compared to the third quarter of 2019 and the fourth quarter of 2018. Also contributing to the linked quarter decrease in net income was a $3.4 million decrease in securities gains, net, in the fourth quarter of 2019, compared to the third quarter of 2019. Partially offsetting these negative variances was the addition of a death benefit realized on BOLI in the fourth quarter of 2019 and mark to market gains on mortgage servicing rights ('MSRs'), compared to mark to market losses on MSRs in the third quarter of 2019 and the fourth quarter of 2018.

- Net interest and dividend income was $23.2 million for the fourth quarter of 2019, a decrease of $1.6 million, or 6.4%, from $24.8 million for the third quarter of 2019, and a decrease of $1.2 million, or 4.7%, from the fourth quarter of 2018. Net interest and dividend income in the fourth quarter of 2019 was negatively impacted by interest rate reductions over the past year, which more than offset increases in interest income due to loan growth in the year over year period.

- Noninterest income was $9.2 million for the fourth quarter of 2019, a decrease of $2.7 million, or 22.6%, compared to $11.9 million for the third quarter of 2019, and an increase of $2.7 million, or 42.1%, compared to $6.5 million for the fourth quarter of 2018. The linked quarter decrease was primarily due to a $3.4 million decrease in securities gains, net. These decreases were partially offset by the addition of a $872,000 death benefit realized on BOLI in the fourth quarter of 2019 and $240,000 of mark to market gains on MSRs, compared to $946,000 of mark to market losses on MSRs in the third quarter of 2019. The increase in noninterest income in the year over year period was primarily driven by the addition of a $872,000 death benefit realized on BOLI in the fourth quarter of 2019 and a $1.7 million increase in total mortgage banking revenue.

- Noninterest expense was $19.8 million for the fourth quarter of 2019, a decrease of $126,000, or 0.6%, compared to $20.0 million for the third quarter of 2019, and an increase of $1.1 million, or 5.6%, from $18.8 million for the fourth quarter of 2018. The linked quarter decrease was primarily attributable to decreases in salaries and employee benefits and computer and data processing costs, partially offset by increases in consulting fees included within other expense. The increase in noninterest expense in the year over year period was primarily attributable to higher salaries and employee benefits expense, occupancy, furniture and equipment expense and debit card interchange expense, partially offset by a decrease in other expense, primarily consisting of consulting and deferred director compensation related expense.

- The provision for income taxes totaled $2.9 million for the fourth quarter of 2019, compared to $4.0 million for the third quarter of 2019 and $2.9 million for the fourth quarter of 2018. The linked quarter decrease of $1.1 million was primarily due to a decrease of $3.8 million in pretax income in the fourth quarter of 2019, compared to the third quarter of 2019. A minimal change in the provision for income taxes in the year over year quarterly period was realized, as the increase in pre-tax income was due to the BOLI death benefit, which is nontaxable.

- On January 21, 2020, our Board of Directors declared a cash dividend of $0.01 per share payable on February 10, 2020, to stockholders of record as of January 31, 2020.

Capital Ratios

| Minimum Capital | Well Capitalized | |||||||||||||||||||

| Adequacy with | Under Prompt | |||||||||||||||||||

| Capital Conservation | Corrective Action | December 31, | September 30, | December 31, | ||||||||||||||||

| Buffer, if applicable1 | Provisions2 | 2019 | 2019 | 2018 | ||||||||||||||||

The Company | ||||||||||||||||||||

Common equity tier 1 capital ratio | 7.00 | % | N/A | 11.14 | % | 10.89 | % | 9.29 | % | |||||||||||

Total risk-based capital ratio | 10.50 | % | N/A | 14.53 | % | 14.34 | % | 12.63 | % | |||||||||||

Tier 1 risk-based capital ratio | 8.50 | % | N/A | 13.65 | % | 13.45 | % | 11.78 | % | |||||||||||

Tier 1 leverage ratio | 4.00 | % | N/A | 11.93 | % | 11.54 | % | 10.08 | % | |||||||||||

The Bank | ||||||||||||||||||||

Common equity tier 1 capital ratio | 7.00 | % | 6.50 | % | 14.35 | % | 14.83 | % | 13.29 | % | ||||||||||

Total risk-based capital ratio | 10.50 | % | 10.00 | % | 15.23 | % | 15.72 | % | 14.14 | % | ||||||||||

Tier 1 risk-based capital ratio | 8.50 | % | 8.00 | % | 14.35 | % | 14.83 | % | 13.29 | % | ||||||||||

Tier 1 leverage ratio | 4.00 | % | 5.00 | % | 12.50 | % | 12.68 | % | 11.36 | % | ||||||||||

1 Amounts are shown inclusive of a capital conservation buffer of 2.50%. Under the Federal Reserve's Small Bank Holding Company Policy Statement, the Company is not subject to the minimum capital adequacy and capital conservation buffer capital requirements at the holding company level, unless otherwise advised by the Federal Reserve (such capital requirements are applicable only at the Bank level). Although the minimum regulatory capital requirements are not applicable to the Company or the Tier 1 Leverage ratio, we calculate these ratios for our own planning and monitoring purposes.

2 The prompt corrective action provisions are only applicable at the Bank level.

- The ratios shown above exceed levels required to be considered 'well capitalized.'

Asset Quality & Earning Assets

- Nonperforming loans totaled $15.8 million at December 31, 2019, compared to $13.4 million at September 30, 2019, and $16.3 million at December 31, 2018. Credit metrics continue to be relatively stable regarding nonperforming loan levels, and management is carefully monitoring loans considered to be in a classified status. Nonperforming loans as a percent of total loans were 0.8% at December 31, 2019, 0.7% at September 30, 2019, and 0.9% at December 31, 2018. Purchased credit impaired ('PCI') loans acquired in our acquisition of ABC Bank totaled $8.6 million, net of purchase accounting adjustments, at December 31, 2019. We do not consider PCI loans, which showed evidence of deteriorated credit quality at acquisition, to be nonperforming assets if their cash flows and the timing of such cash flows continue to be estimable and probable of collection.

- OREO assets totaled $5.0 million at December 31, 2019, compared to $4.7 million at September 30, 2019, and $7.2 million at December 31, 2018. We recorded writedowns of $120,000 in the fourth quarter of 2019, compared to $203,000 in the third quarter of 2019, and $96,000 in the fourth quarter of 2018. Nonperforming assets, as a percent of total loans plus OREO, were 1.1% at December 31, 2019, 0.9% at September 30, 2019, and 1.2% at December 31, 2018.

- Total loans were $1.93 billion at December 31, 2019, reflecting an increase of $31.0 million compared to September 30, 2019, and an increase of $33.8 million compared to December 31, 2018, due primarily to growth in our commercial, leases, and real estate-commercial portfolios. Average loans (including loans held-for-sale) for the fourth quarter of 2019 were $1.90 billion, reflecting an increase of $7.8 million from the third quarter of 2019 and an increase of $45.4 million from the fourth quarter of 2018. Growth in the year over year period is due to organic growth in our leases, commercial, and real estate-commercial portfolios.

- Available-for-sale securities totaled $484.6 million at December 31, 2019, compared to $488.4 million at September 30, 2019, and $541.2 million at December 31, 2018. Total securities available-for-sale remained relatively unchanged over the linked quarters, and a decline of $56.6 million was realized in the year over year period due primarily to security sales recorded in the third quarter of 2019.

Non-GAAP Presentations: Management has disclosed in this earnings release certain non-GAAP financial measures to evaluate and measure our performance, including the presentation of net interest income and net interest margin on a fully taxable equivalent basis and our efficiency ratio calculations. The net interest margin is calculated by dividing net interest income on a tax equivalent basis by average earning assets for the period. Management believes this measure provides investors with information regarding balance sheet profitability. Consistent with industry practice, management has disclosed the efficiency ratio including and excluding

Forward-Looking Statements: This earnings release contains forward-looking statements. Forward looking statements can be identified by words such as 'anticipated,' 'expects,' 'intends,' 'believes,' 'may,' 'likely,' 'will' or other that indicate future periods. Such forward-looking statements are subject to risks, uncertainties, and other factors, including a downturn in the economy, particularly in our markets, volatile credit and financial markets both domestic and foreign, potential deterioration in real estate values, regulatory changes and excessive loan losses, as well as additional risks and uncertainties contained in the 'Risk Factors' and forward-looking statements disclosure contained in our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, any or all of which could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The inclusion of this forward-looking information should not be construed as a representation by us or any person that future events, plans, or expectations contemplated by us will be achieved. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Conference Call

We will host an earnings call on Thursday, January 23, 2020 at 11:00 a.m. Eastern Time (10:00 a.m. Central Time). Investors may listen to our earnings call via telephone by dialing 844-602-0380. Investors should call into the dial-in number set forth above at least 10 minutes prior to the scheduled start of the call.

A replay of the earnings call will be available until 11:00 a.m. Eastern Time (10:00 a.m. Central Time) on January 30, 2020, by dialing 877-481-4010, using Conference ID: 57046.

CONTACT:

Bradley S. Adams

Chief Financial Officer

(630) 906-5484

SOURCE: Old Second Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/573727/Old-Second-Reports-Fourth-Quarter-2019-Net-Income-of-95-million

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Raleigh Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Raleigh Times.

More InformationBusiness

SectionAI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

North Carolina

SectionCDC: US records 1,288 measles cases, most since 1992 outbreak

ATLANTA, Georgia: The United States is facing its worst measles outbreak in more than three decades, with 1,288 confirmed cases so...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Tigers' All-Star Casey Mize hunts 10th win vs. Mariners

(Photo credit: Ken Blaze-Imagn Images) Casey Mize got some big news before his final start prior to the All-Star break. The Detroit...

Cal Raleigh smacks two more HRs, Mariners beat Tigers

(Photo credit: Lon Horwedel-Imagn Images) Cal Raleigh blasted his major league-leading 37th and 38th home runs, including a grand...

Reports: Matt Olson to replace Ronald Acuna Jr. in Home Run Derby

(Photo credit: Dale Zanine-Imagn Images) Matt Olson will replace Atlanta Braves teammate and fellow All-Star Ronald Acuna Jr. in...

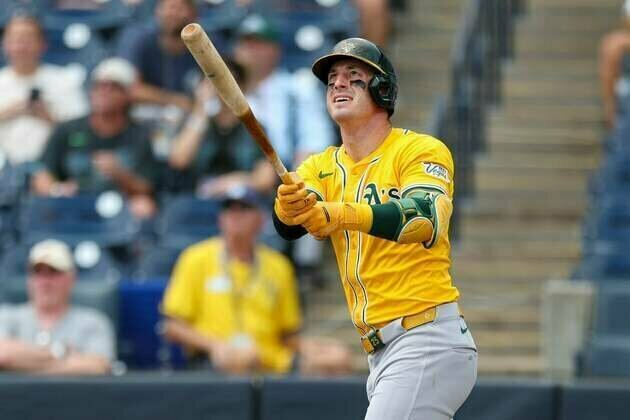

A's Brent Rooker, Yankees' Jazz Chisholm Jr. round out HR Derby field

(Photo credit: Nathan Ray Seebeck-Imagn Images) Athletics designated hitter Brent Rooker and New York Yankees second baseman Jazz...