Insurance Agency Mergers and Acquisitions YTD Set Record

ACCESS Newswire

19 Oct 2021, 19:55 GMT+10

Deals for property & casualty and benefits brokers in US and Canada rise 13% through Q3 2021, OPTIS Partners reports-highest ever for first nine months of year

CHICAGO, IL / ACCESSWIRE / October 19, 2021 / There were 553 announced insurance agency mergers and acquisitions during the first three quarters of 2021, up from 490 in 2020, according to OPTIS Partners' M&A database. It was the highest recorded total for this period.

The data covers U.S. and Canadian agencies selling primarily property-and-casualty insurance, agencies selling both P&C and employee benefits, and those selling only employee benefits.

'Multiple factors that drive deal activity continue unabated. An aging group of owners looking at all-time high valuations and expecting future tax increases is met by a larger group of buyers needing to fuel inorganic growth,' said Steve Germundson, partner of OPTIS Partners, an investment banking and financial consulting firm specializing in the insurance industry.

The report breaks down buyers into four groups: private equity-backed/hybrid brokers, privately held brokers, publicly held brokers, and all others.

Acrisure leads buyer list

Acrisure led all buyers with 79 transactions year-to-date, far more than any other buyer, and back on track with their historical pace, which had slowed earlier this year. Other top buyers were PCF Insurance and BroadStreet Partners, both with 31 deals (up from 22 and 40 in 2020, respectively), World Insurance Associates with 27 (up from 22), and Hub International with 25 (down from 40).

Of the 10 most active buyers, only three completed fewer deals through three quarters of 2021 versus 2020: Hub declined by 15, BroadStreet had nine fewer deals, and AssuredPartners dropped by three. Relation Insurance, High Street Partners, and Alera each more than doubled the number of transactions completed.

Private equity-backed/hybrid group dominates buyers

The private equity-backed/hybrid group of buyers did 70% of all transactions so far in 2021, which is comparable to the same period in 2020 while acquisitions by privately held brokers inched upwards from 18% to 20%. The publicly traded brokers slipped from 10% to 6% of total transactions as their deal count fell 32% year-over-year.

P&C sellers accounted for 313 of the total 553 transactions (57%), consistent with their percentage of the totals in recent years.

Hot pace expected to continue

'The fourth quarter of 2021 may not reach the massive volume of deals done in the last quarter of 2020, but it will likely be close. A number of active buyers have told us one of their biggest challenges is lining up legal and due-diligence providers for the remainder of the year,' said Dan Menzer, partner at OPTIS.

'There is nothing on the horizon that indicates a material slowing of deal activity, absent true economic disruption, even if we see a modest increase in capital gains taxes and rise in interest rates,' said Tim Cunningham, managing partner. 'During the biggest economic disruption since 2008, OPTIS has handled more deals than ever. There's just so much capital continuing to look for sound investments.'

The full report can be read at https://optisins.com/wp/2021/10/sep-2021-ma-report/.

OPTIS Partners has consistently been ranked in the top six most active agent-broker M&A advisory firms for 2014 - 2019 by S&P Global Market Intelligence.

Focused exclusively on the insurance-distribution marketplace, Chicago-based OPTIS Partners (www.optisins.com) offers merger & acquisition representation for buyers and sellers, including due-diligence reviews. It provides appraisals of fair market value; financial performance review, including trend analysis and internal controls; and ownership transition and perpetuation planning.

Contact: Tim Cunningham, OPTIS Partners, [email protected], 312-235-0081

Dan Menzer, OPTIS Partners, [email protected], 630-520-0490

Steve Germundson, OPTIS Partners, [email protected] 612-758-0598

Henry Stimpson, Stimpson Communications, 508-647-070 [email protected]

SOURCE: Global IQX

View source version on accesswire.com:

https://www.accesswire.com/668604/Insurance-Agency-Mergers-and-Acquisitions-YTD-Set-Record

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Raleigh Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Raleigh Times.

More InformationBusiness

SectionTrump-backed $1.5 billion golf project breaks ground near Hanoi

HUNG YEN, Vietnam: A new US$1.5 billion luxury golf and residential project backed by the Trump Organization officially broke ground...

Aussie firms upbeat on China outlook despite trade tensions

SYDNEY, Australia: Australian businesses are feeling optimistic about their prospects in China despite escalating global trade tensions,...

Russia’s top oil company takes over largest rare earth deposit

MOSCOW, Russia: Russia's top oil company, Rosneft, has taken over control of the country's largest rare earth metals deposit, Tomtor,...

Volvo Cars steps up partnership with Google to make Android software

GOTHENBURG, Sweden: Volvo Cars is stepping up its collaboration with Google to become the lead development partner for Android automotive...

U.S. stocks in retreat after Trump wages war on European Union

NEW YORK, New York - U.S. stock markets fell Friday as President Donald Trump launched an extraordinary attack on the European Union,...

Levi’s to sell Dockers brand for $311 Million, focus on care labels

SAN FRANCISCO, California: Levi Strauss is parting ways with Dockers. The denim giant announced this week that it will sell the Dockers...

North Carolina

SectionAppeals court clears Trump’s rollback plan for worker protections

WASHINGTON, D.C.: A federal appeals court recently lifted a block that had stopped President Donald Trump's administration from removing...

Corey Heim runs away with Truck Series race at Charlotte

(Photo credit: Mark J. Rebilas-Imagn Images) CONCORD, N.C. -- This time, Corey Heim didn't just slam the door on his NASCAR CRAFTSMAN...

Etihad Airways expands US network with first flights to North Carolina

ABU DHABI, 16th May, 2025 (WAM) -- Etihad Airways has announced a new addition to its growing US network with the launch of non-stop...

States Can Take Meaningful Climate Action, Even Without Federal Support: Study

State action to reduce carbon emissions and address climate change can make a big difference, even in the absence of a strong federal...

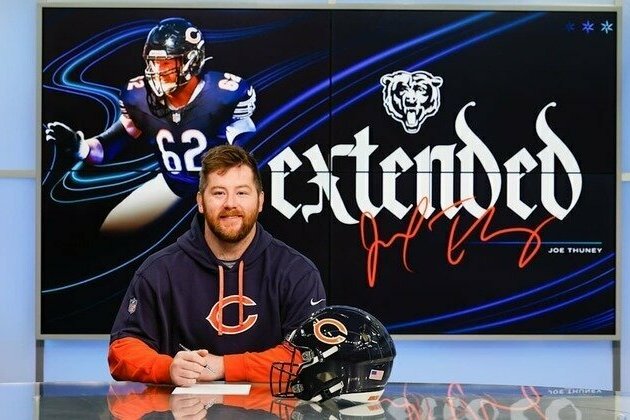

Joe Thuney details why he wanted to remain with Bears long term

Larry Mayer When the Bears acquired Joe Thuney in a trade with the Chiefs in mid-March, the four-time All Pro guard arrived with...

Roster Moves: Chicago Bears sign OL Joe Thuney to two-year extension

Chicago Bears The Chicago Bears on Wednesday signed veteran offensive linemanJoe Thuneyto a two-year extension through 2027. We...