SSB Bancorp, Inc Reports Unaudited Consolidated Financial Results For the Year Ended December 31, 2022

ACCESS Newswire

04 Feb 2023, 03:13 GMT+10

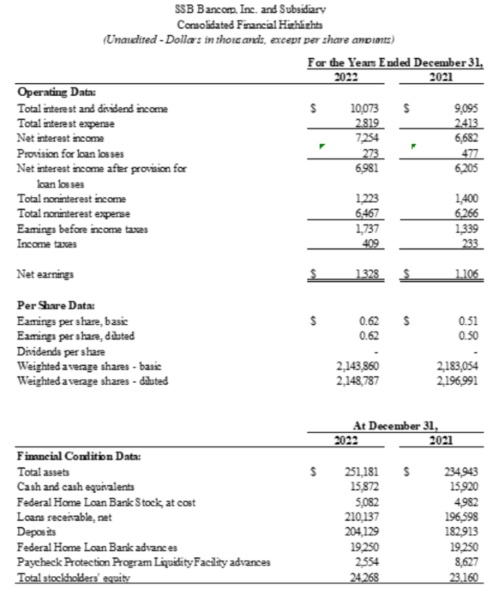

PITTSBURGH, PA / ACCESSWIRE / February 3, 2023 / SSB Bancorp, Inc (OTC PINK:SSBP - news) (the 'Company'), the holding company for SSB Bank (the 'Bank'), today announced the Company's unaudited, consolidated results of operations for the year ended December 31, 2022.

Total assets increased $16.2 million to $251.2 million at December 31, 2022, from $234.9 million at December 31, 2021. The increase in assets was due to an increase in deposits of $21.2 million. The increase in deposits was converted into a net increase of $13.5 million in loans as well as the decrease in Paycheck Protection Program Liquidity Facility advances of $6.1 million.

Net earnings for the year ended December 31, 2022, was $1.3 million, or $0.62 per basic and diluted share, compared to net earnings of $1.1 million, or $0.51 per basic and $0.50 per diluted share, for the prior year.

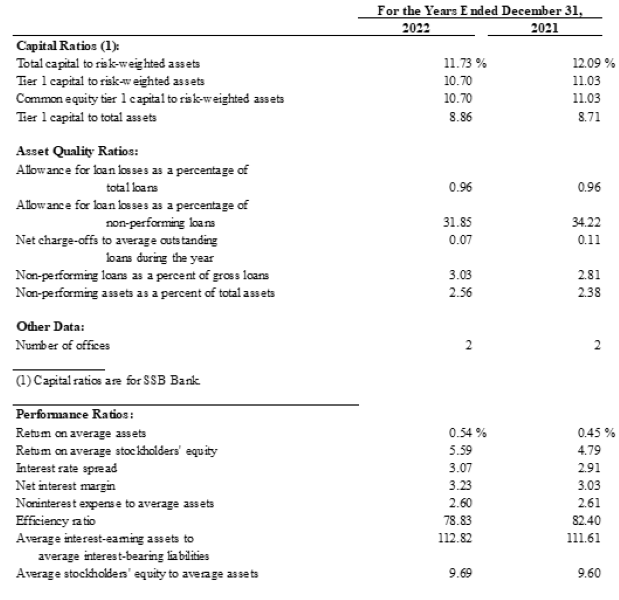

Total interest and fee income increased by $978,000, or 10.8%, when comparing the results of the year ended December 31, 2022, with the year ended December 31, 2021. This is due to the increase in average interest-earning assets from $220.2 million to $224.8 million as well as the increase in yield from 4.13% to 4.48% when comparing the two periods.

Interest expense increased by $406,000, or 16.8%, to $2.8 million in the year ended December 31, 2022, from $2.4 million in the year ended December 31, 2021. The increase in interest expense is due to the increase in cost of interest-bearing liabilities from 1.22% for the year ended December 31, 2021, to 1.41% for the year ended December 31, 2022.

Noninterest income decreased by $178,000, or 12.7% to $1.2 million from $1.4 million when comparing the year ended December 31, 2022, with the year ended December 31, 2021. With the rise in market interest rates, mortgage loan production has decreased, and has resulted in a decrease in gain on sale of loans of $612,000 when comparing the two periods. Offsetting this decrease is the increase in merchant acquirer sponsorship fees of $406,000 when comparing the two periods.

Noninterest expense increased by $201,000 or 3.2% to $6.5 million. This was mainly due to increases in salaries and benefits, occupancy, and federal deposit insurance when comparing the year ended December 31, 2022, with the year ended December 31, 2021.

This release may contain forward-looking statements within the meaning of the federal securities laws. These statements are not historical facts; rather, they are statements based on the Company's current expectations regarding its business strategies and their intended results and its future performance. Forward-looking statements are preceded by terms such as 'expects', 'believes', 'anticipates', 'intends' and similar expressions.

Forward-looking statements are not guarantees of future performance. Numerous risks and uncertainties could cause or contribute to the Company's actual results, performance and achievements to be materially different from those expected or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government; legislative and regulatory changes.

Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere from time to time by the Company or on its behalf. The Company assumes no obligation to update any forward-looking statements.

Contact information:

Ben Contrucci - [email protected]

Dan Moon - [email protected]

April Miller - [email protected]

Phone: 412-837-6955

SOURCE: SSB Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/738105/SSB-Bancorp-Inc-Reports-Unaudited-Consolidated-Financial-Results-For-the-Year-Ended-December-31-2022

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Raleigh Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Raleigh Times.

More InformationBusiness

SectionFilmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

AI boom propels Nvidia to historic market cap milestone

SAN FRANCISCO, California: Nvidia, the Silicon Valley chipmaker at the heart of the artificial intelligence boom, this week briefly...

AI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

North Carolina

SectionCDC: US records 1,288 measles cases, most since 1992 outbreak

ATLANTA, Georgia: The United States is facing its worst measles outbreak in more than three decades, with 1,288 confirmed cases so...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

MLB roundup: Garrett Crochet tosses first shutout in Red Sox win

(Photo credit: Eric Canha-Imagn Images) In his 51st career start, Garrett Crochet accomplished two feats in one dominant outing:...

Tigers limping to break as they host Mariners in first-half finale

(Photo credit: Brad Mills-Imagn Images) The Detroit Tigers will head into the All-Star break with the best record in the majors,...

Mariners unload on offense to roll past Tigers 15-7

(Photo credit: Rick Osentoski-Imagn Images) Randy Arozarena had three hits, including a two-run homer, and scored four runs as the...

MLB roundup: Yanks bomb Cubs on Cody Bellinger's 3 HRs

(Photo credit: Wendell Cruz-Imagn Images) Cody Bellinger hit three homers for the first time in his career and drove in six runs,...